Despite a slight decline in 2024, global real estate remains the world’s largest “piggy bank”, with a total value of $393.3 trillion at the end of the year, according to the latest Savills report (October 2025).

Real estate continues to outperform the global equity and bond markets combined, while the comparison with gold is revealing: the total value of all gold mined corresponds to just 5% of the value of real estate worldwide.

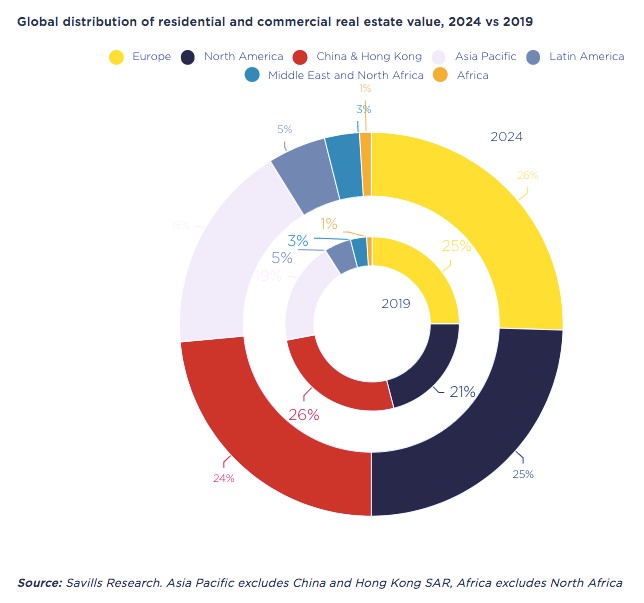

In 2024, there was a small annual decline of 0.5% in global real estate values – a development that is mainly attributed to a 2.7% decline in residential real estate, mainly due to China, which accounts for around 25% of global housing value. In contrast, in most countries, house prices rose, supported by strong demand and new supply.

By comparison, at the end of 2022 (October 2023 data), the value of real estate had reached $379.7 trillion, recording an annual decline of 2.8%, mainly due to interest rates and economic uncertainty.

The value of commercial real estate increased by 4.1% annually, reaching $58.5 trillion, boosted by new developments and price stabilization. Investments in productive units – e.g. in the US through onshoring policies – further strengthened the sector.

Equally impressive was the rise in the value of agricultural land, which increased by 7.9%, reaching $47.9 trillion. This growth is driven by rising global demand for food, energy and raw materials, combined with declining supply due to urbanization and land degradation.

North America dominates

Among regions, North America saw the biggest increase (+44% since 2019), increasing its share of global real estate value from 21% to 25%. This growth is driven by a solid US economy and new construction.

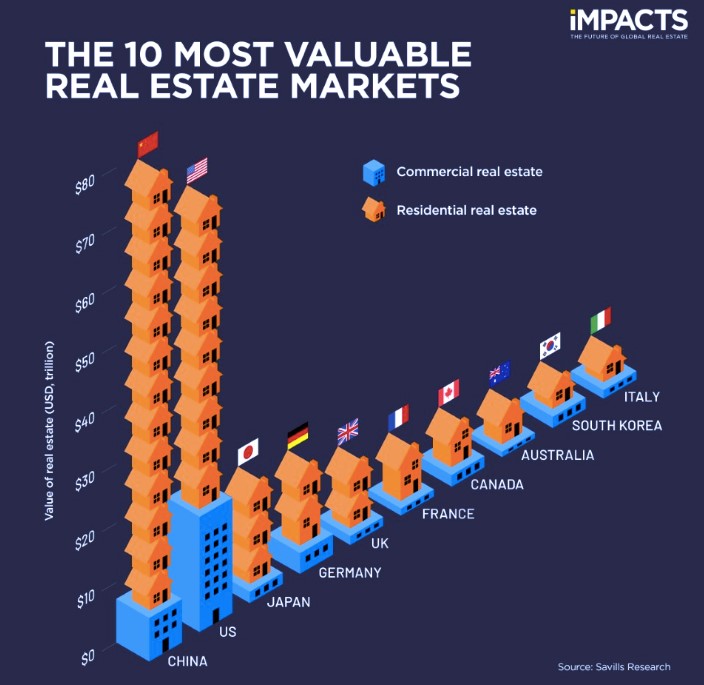

China maintains its position as the most expensive real estate market in the world, with 23.5% of the total value, while the US follows with 20.7%. The top ten is completed by Japan, Germany, the UK, France, Canada, Australia, South Korea and Italy – with a combined share of 71% of global value.

By comparison, in 2022 (2023 data) China held 26% of the global value and the US 19%, while the G7 together with China represented 2/3 of the global market.

Growth under pressure - Where are the opportunities

The global real estate market is not only the largest “repository of wealth”, but also a mirror of macroeconomic and geopolitical developments. Despite the pressures, the real estate market remains three times more valuable than global equity markets. Structural needs for housing, development and infrastructure will continue to support demand.

High interest rates and low affordability may slow residential real estate growth, especially in China, but the political shift in favor of increasing housing supply in many countries is a potential counterweight.

The commercial sector looks set to continue its rise, driven by investments in data centers, artificial intelligence and new industrial plants.

Agricultural land, as a limited natural resource with a key role in climate resilience and food security, is expected to continue its upward trajectory.

SOURCE: ered.gr